Your sustainable investment to support good food for all.

Your direct loan supports the creation of a democratic, inclusive, and ecological supermarket in Vienna! Do you want to make a specific, meaningful project possible with your money? The cooperative MILA offers you exactly this opportunity.

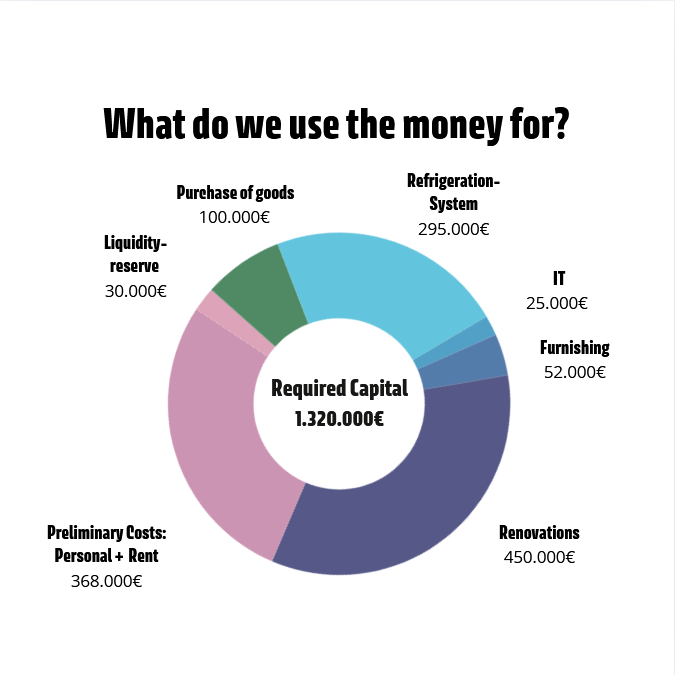

Direct loans offer you the opportunity to support MILA directly with your money – without having to go through a bank. Your direct loan enables MILA to be financed while minimising expensive bank loans, while you can benefit from fair interest rates of up to 2%.

Your advantages when you give MILA a direct loan:

- You have full transparency about how your money is used in the MILA participatory supermarket and actively contribute to the realisation of our project.

- You receive fair interest for your direct loan up to 2 % per year.

- You decide the amount of your direct loan, the term and the type of interest. You can use the shopping vouchers directly at MILA to enjoy your purchases!

With your support, we will make the participatory supermarket a success and reward you for your trust in our project at the same time.

Why does MILA need direct loans?

- Your direct loan enables MILA to get started directly at our new location. We are starting from the best position!

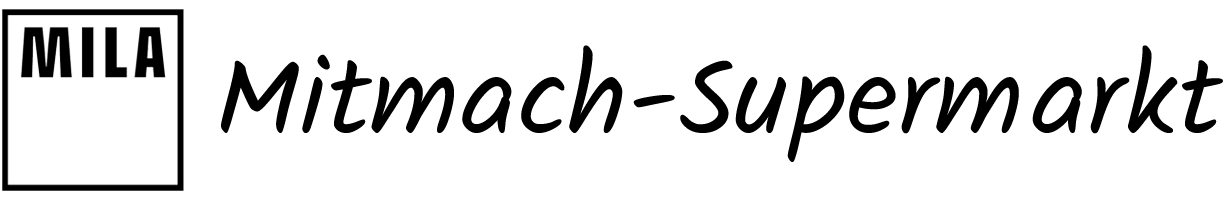

- We will use the direct loans to pre-finance the investment costs incurred for the opening of the supermarket.

- Your money will now be used specifically for investments at the new location.

We would rather have many direct lenders behind us than a bank breathing down our necks, because: Direct loans have better conditions for MILA than bank loans. Direct loans count as equity and make it much easier for us to get a loan from a bank on better terms.

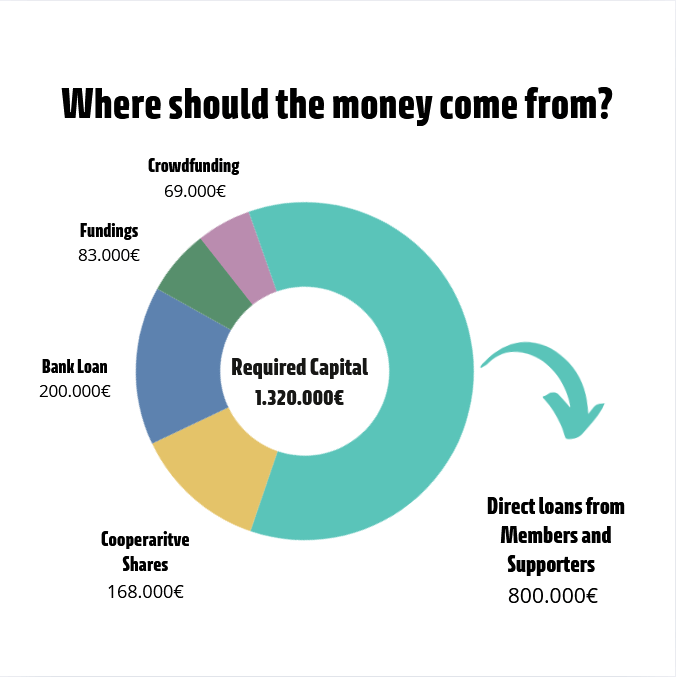

Current status

Why did you give MILA a direct loan?

3 Steps to a Direct Loan

1) Fill in and send off the direct loan agreement

Fill out the digital form directly online with your details for the direct loan agreement.

2) MILA checks your submission and sends you the contract and account access

We check the contract for completeness and sign it from our side. The contract is then uploaded to the MILA platform and you can log in to your account using the email address you provided in the contract. We will inform you by e-mail. On the MILA platform, you can download the contract, check your current account balance and request your annual account statement **.

3) Transfer direct credit

After you have received the account access, we ask you to transfer the amount of the direct loan to our account.

Interest will begin to accrue once your payment has been credited to the MILA account.

Do you have any questions? Then get in touch at: mitmachen@mila.wien

If you give us your telephone number, we will be happy to call you back.

* For sums of €5,000 or more, we need an additional signature on the contract. If you complete the contract using the online form, we will contact you by e-mail.

** If you do not have an e-mail address, we will send you your contract and your account balance once a year by letter to the postal address stated in the contract.